A money multiplier is one of many closely related ratios of commercial bank money to central bank money in a fractional-reserve banking system, according to monetary economics. Given a certain amount of central bank money, it refers to the maximum amount of commercial bank money that can be created.

The fractional banking system relies heavily on the money multiplier.

- The number of bank deposits initially rises (monetary base).

- The bank keeps a portion of the deposit in reserve and then lends the rest out.

- This bank loan gets a re-deposit in banks. Thus, this enables even more bank lending and an expansion of the money supply.

Would you like to know more about the Money Multiplier formula? If your answer is a YES, then worry not; you’re on the correct site. Read along to get a detailed view of the concept.

Multiplier Effect

The multiplier effect is the proportional increase or decrease in final revenue that occurs as a result of spending, injection, or withdrawal. Companies utilize the most basic multiplier to assess investment efficiency. And you can compute it as a change in income ÷ change in spending. The money supply multiplier examines the multiplier effect in the context of banking and money supply.

Understanding the Concept of Money Multiplier

The money multiplier is a phenomenon in which money creation takes place in the economy through credit creation. The fractional reserve banking system allows money creation in the market. Alternative terms for money multiplier are credit multiplier and monetary multiplier.

It is the utmost extent to which changes in the number of money deposits put by persons in the market can affect the money supply. You can see the effect of money multiplier in the economy’s commercial banks, as we already discussed earlier. Commercial banks accept money and deposits. Subsequently, they maintain a portion of the money as a reserve and lend the rest to the people as loans.

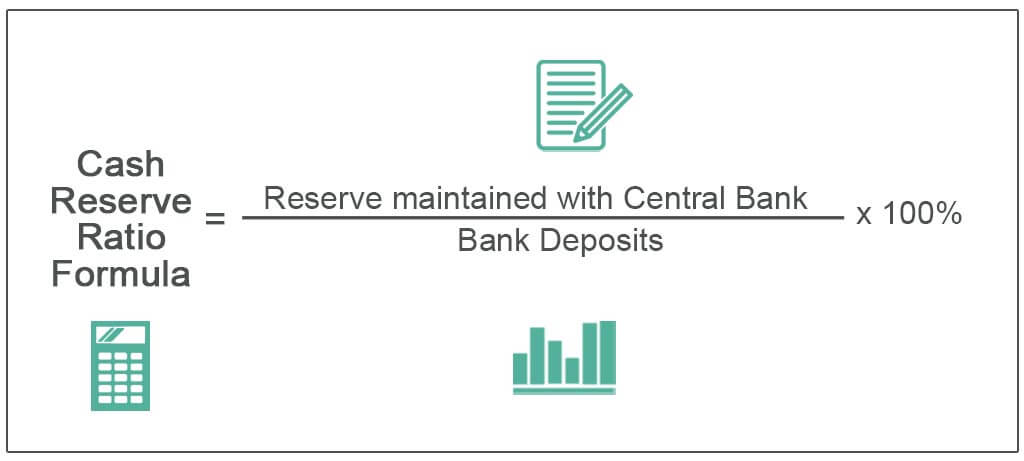

The reserve ratio (required reserve ratio or cash reserve ratio) is the amount of money these commercial banks retain as reserves for the withdrawal purposes of depositors at any one time.

Relevance of Money Multiplier

Relevance of Money Multiplier

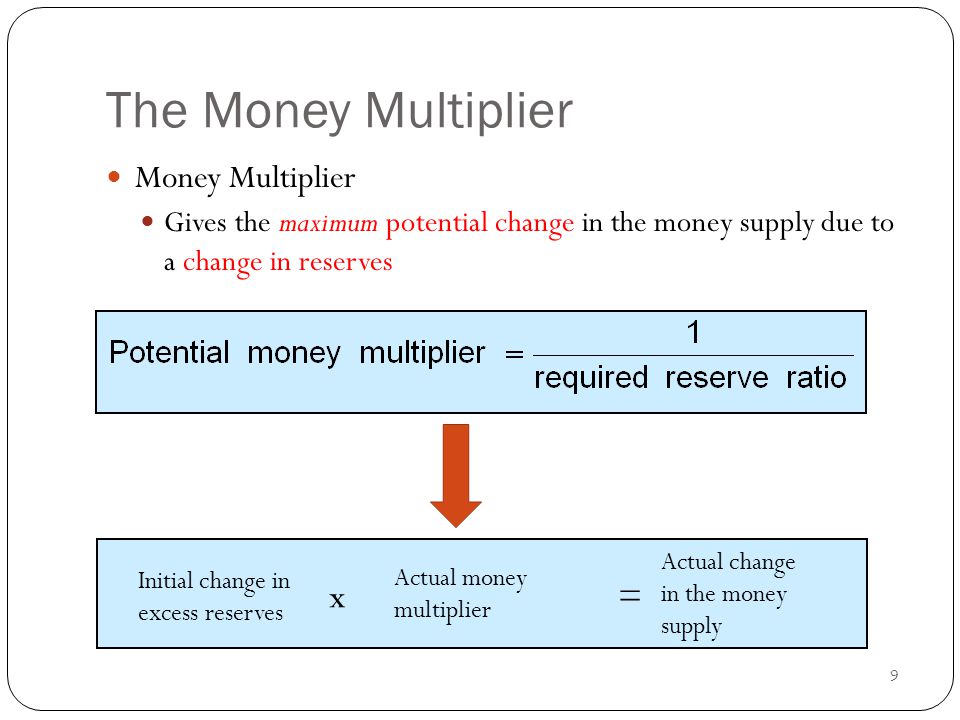

The money multiplier is a very crucial topic in banking economics. Likewise, it is a major component of the fractional banking system that regulates an economy’s money supply. The money multiplier, in reality, determines how much money the banking system generates for each dollar of reserves. The higher the reserve requirement, theoretically, the less money the banking system can utilize to provide loans. Henceforth, this leads to less money in circulation. As a result, the reserve ratio is inversely proportional to the money multiplier.

Read Also: How are Plasma and Serum different from each other?

It is important to highlight, however, that the production of money will not stop here. Likewise, the freshly created money will get a deposit in a different bank. Therefore, it will then lend a percentage of that money to many different consumers, and this process will continue. In theory, this process keeps on continuing indefinitely though.

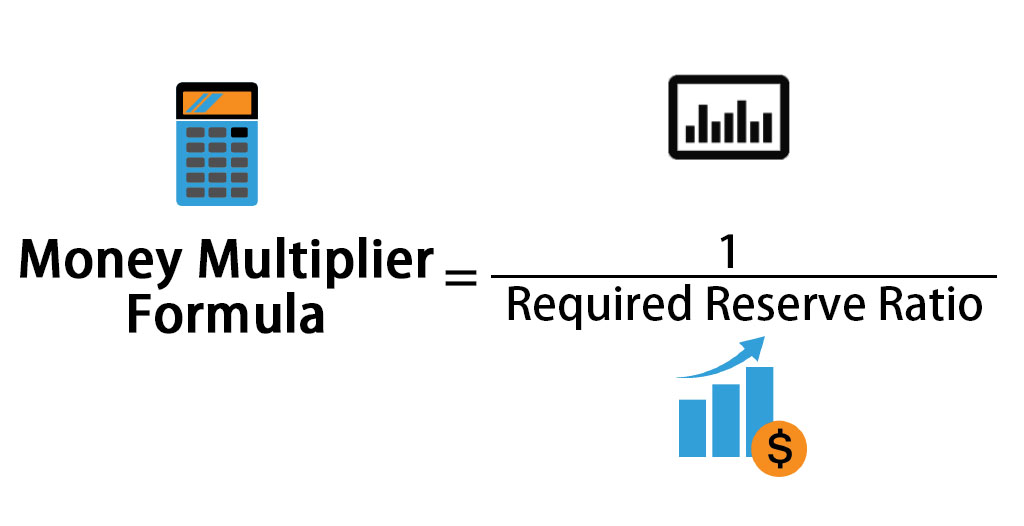

Money Multiplier Formula

We can state the concept of a money multiplier mathematically by using the following formula:

Money Multiplier = 1/LRR or 1/r

Here, LRR denotes the legal reserve ratio. It is the legal minimum deposit ratio. Commercial banks in the economy must maintain this with each other and with the Reserve Bank of India (RBI).

For example, if your LRR is 20%, then you can expect a money multiplier of 1/0.2 = 5.

Example employing the Money Multiplier Formula

Tim and Tia are arguing with each other on the subject of a money multiplier. While Tim claims that if the reserve ratio is low, the more money supplies in the economy, the lower the inflation. On the contrary, Tia claims that the greater the ratio, the less money supply, and hence the lower the inflation. Now, we need to determine which assertion is right, by taking an example of 7% versus 8% as the reserve ratio.

For Tim,

Reserve Ratio = 7%

Therefore, money multiplier = 1/0.07 = 14.29

However, for Tia,

Reserve Ratio = 8%

Henceforth, money multiplier = 1/0.08 = 12.5

From the above, we can deduce that maintaining a reserve ratio of 7% will infuse more money because it will be circulated more while maintaining a reserve ratio of 8% will inject less money.

As a result, if more money enters the market, inflation will rise, and vice versa. Therefore, Tia’s statement that a higher reserve ratio will lower inflation is correct, while Tim’s statement is incorrect.

Legal Reserve Ratio Types

The 2 types of legal reserve ratios are as follows:

- CRR (Cash Reserve Ratio) – This type of ratio refers to the minimum percentage of a commercial bank’s total deposits that it must remain with the central bank or RBI.

- SLR (Statutory Liquidity Ratio) – It refers to the minimum proportion of net total demand and time liabilities that commercial banks have an obligation to hold. Essentially, it is the minimum reserve of the entire deposit that commercial banks must keep with themselves.

Real-World Applications of Money Multiplier

Nonetheless, there are many reasons why the actual money multiplier is much lower than the theoretically possible money multiplier in the real world.

- Import Spending – When people buy imports, money leaves the economy.

- Taxes – Taxes get a deduction from your gross income.

- Savings – Money is neither spent nor distributed in its whole; a considerable sum will be saved.

- Currency Drain Ratio – Individual consumers hold this % of banknotes in cash rather than depositing them in banks. There would be a higher money multiplier if customers put all of their cash in banks. However, if consumers hold their money in cash, banks will be unable to lend more.

- Bad Loans – If a bank lends out a huge sum and the company ends up going bankrupt, this amount will never get a deposit back into the banking system.

- Safety Reserve Ratio – This is the % of deposits kept over the statutory reserve ratio that a bank may wish to keep.

- It may be probable that the bank may not be able to lend more money out. Even if banks wanted to, just because they could lend 95% of their deposits doesn’t imply they can. People may not want to borrow during a recession, and instead, they prefer to save.

- Banks may be reluctant to lend. Additionally, banks may refuse to lend at certain times. When they believe enterprises and individuals are more likely to default during a recession, the banks’ reserve ratios increase.

Currency Drainage and Its Effect on Money Multiplier

Currency drainage occurs when there is a rise in the currency stored outside of banks. In reality though, borrowers keep a portion of the monetary loans they receive. A currency drain reduces the money multiplier’s size. Since banks loan their extra reserves, the funds end up as excess reserves in other banks. Furthermore, the banks loan them out again there. Thus, the money multiplier comes into existence then. As a result, a modest increase in reserves and the monetary base doubles up the amount in circulation.

Read Also: Glycolysis – Where What And How Does It Occur?

When banks offer loans, some of the funds may be taken out as cash. Moreover, they may not get deposited in another bank. This condition is a currency drain. As a result, the other banks’ excess reserves do not grow as quickly, limiting the amount they may lend. As the number of loans decreases, the total amount of money increases less, resulting in a smaller money multiplier.

In the case of currency drainage,

Money multiplier = (1 + Drainage Ratio) ÷ (Required Reserve Ratio + Drainage Ratio)