In economics, marginal utility (MU) refers to the additional pleasure or benefit (utility) a buyer receives by purchasing an additional unit of a commodity or service. The idea is that the utility or benefit of an extra unit of a product to a consumer is inversely proportional to the number of units he already owns.

The marginal utility of consuming units may be positive, negative, or zero. The utility is not constant. Hence, for each extra unit consumed, the customer often suffers diminishing MU, in which each subsequent unit adds less and less MU.

If you would like to know more about the origin, concept, and application of Marginal Utility, then you are welcome here. Scroll down and read along to clear all your doubts about the topic.

Understanding the Concept of Marginal Utility

Carl Menger, an economist, had articulated the ‘Paradox of Diamond-Water.’ As a result, it led to the emergence of the marginal utility revolution. He applied the ordinal utility theory to explain how consumers utilize preference to assign a higher value to one consumption unit over another.

In this situation, a consumption unit that provides more utility is given more priority and value over the others. Over time, the perceived value will be adding little to the consumer’s satisfaction. And hence, this will result in negative or zero marginal utility for the consumer.

Read Also: SO2 – A Detailed Discussion

Economists used cardinal utility theory to explain how to evaluate utility to quantify satisfaction. We measure it in units called utils. The first consumed unit receives higher marginal utils, but successive units receive lower and lower marginal utils. In this context, either of the two utility theories tries to understand the willingness of customers to consume an extra unit of a good or service. As a result, economists employ marginal utility to analyze and understand this behavior.

History of Marginal Utility

Economists devised the notion of marginal utility to explain the economic reality of price. They felt a product’s utility drove it. Adam Smith, an economist, discussed ‘the paradox of water and diamonds’ in the 18th century. Although water is essential to human life, this paradox claims that water has significantly less value than diamonds.

Read Also: Carbohydrates Monomers and Polymers: Definition and Examples

This disparity piqued the interest of economists and philosophers all around the world. 3 economists – William Stanley Jevons, Carl Menger, and Leon Walras, independently concluded in the 1870s that marginal utility was the solution to the water and diamonds paradox. Economic decisions are decided based on ‘final’ (marginal) utility rather than total utility, according to Jevons’ book ‘The Theory of Political Economy.’

Types of Marginal Utility

Marginal utility is of 3 types:

- Positive Marginal Utility – It is the excitement (utility) that comes with increasing the number of units consumed.

- Zero Marginal Utility – When a customer becomes indifferent to consuming the following extra unit, this takes place.

- Negative Marginal Utility – When an extra unit of consumption leads to harm or damage, it results in this condition.

Explaining Marginal Utility with an Example

Suppose there are two friends – John and Jenny. John has 4 cupcakes, whilst Jenny has 20. They both now decide to go and purchase another cupcake from the local bakery. Thus, this increases John’s total from 4 to 5. Further, in turn, his utility also increases. Therefore, the number of cupcakes he owns now increases by 25 percent.

After Jenny also purchases another cupcake, it brings her total from 20 to 21. Her utility also increases subsequently. Nevertheless, the total number of cupcakes she owns presently only increases by 5 percent.

Read Also: Money Multiplier Formula

To sum up, the above example explains – the bigger a person’s quantity, the lower is his marginal utility. Though Jenny collects more cupcakes, the utility she derives from each (marginal) cupcake decreases. This continues to fall until the value placed on that further level of enjoyment is less than the satisfaction received.

Importance of Marginal Utility

The concept of marginal utility is highly useful in the fields of both economics and commerce. It describes how customers make decisions to maximize the value of their limited budgets. People will continue to consume more products in general as long as the marginal utility exceeds the marginal expense. The price equals the marginal cost in an efficient market. That is why consumers continue to buy until their MU of consumption equals the cost of the commodity.

Law of Diminishing Marginal Utility

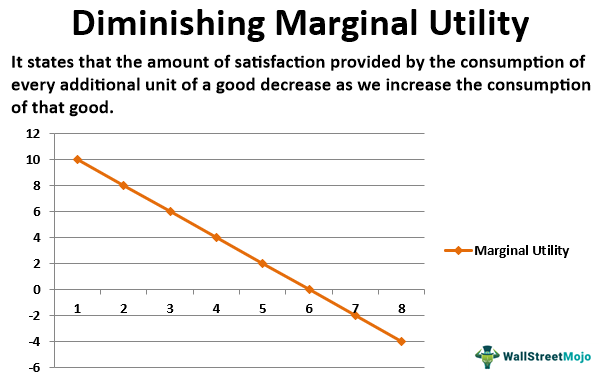

The Law Of Diminishing Marginal Utility (DMU) asserts that as consumption grows, the MU obtained from each extra unit decreases. MU is the change in utility as an extra unit consumed. It states that as a person consumes more and more of a commodity, the satisfaction or utility they obtain from it diminishes.

The Law of Diminishing Marginal Utility asserts that when an individual consumes more of a good or service, its marginal utility decreases. Consuming incremental amounts of a good provides less and less satisfaction to economic agents.

Marginal Utility Formula

The formula for computing marginal utility is as follows:

Change in Total Utility ÷ Change in number of units consumed = Marginal Utility

Conversely, we can also determine marginal utility by subtracting total utility consumed at point ‘n’ from total utility consumed at point ‘z.’ Here, point ‘n’ represents the current level of utility, and point ‘z’ represents the previous level of utility. Next, divide this by the sum of the number of units consumed at point ‘n’ minus the number of units consumed at point ‘z’ to calculate marginal utility.

Example illustrating how to apply the Marginal Utility Formula

Let us take the example of Hazel, who purchased a pizza having 4 slices. Now, the following information is available regarding his perceived utility after consumption of each slice of the pizza. We now have to calculate the marginal utility of each slice of the pizza.

| No. of Pizza Slices (Q) | Total Utility (TU) |

| 1 | 150 |

| 2 | 225 |

| 3 | 250 |

| 4 | 220 |

Now, to calculate Marginal Utility, we need to use the formula stated below –

Marginal Utility = (TUf – TUi) / (Qf – Qi)

So, for the first slice, MU = (150-0) / (1-0) = 150.

Further, for the second slice, MU = (225-150) / (2-1) = 75.

Additionally, for the third slice, MU = (250-225) / (3-2) = 25

Finally, for the fourth slice, MU = (220-250) / (4-3) = -30

Therefore, as you can see here, the MU of a slice of pizza declines after Hazel eats up the previous one. Moreover, we reach the highest utility point at the consumption of the third slice. And surprisingly, beyond the third slice, the total gets declined. This is a classic example of diminishing marginal utility.

Application of Marginal Utility

The law of diminishing marginal utility has both theoretical and practical applications. Let us have a look at what they are.

Serving as Foundation for Other Laws

The law of DMU is the foundation for the law of demand. Besides, we can use it to show the inverse relationship between the amount demanded and the price. As a result, we can also understand better why the demand curve is slanted downward. Likewise, while discussing a single need at a time, this law is important. You can get a better understanding of other concepts such as consumer behavior and equilibrium.

Helpful in Business

One of the most crucial business concerns is product pricing. We realize that a product’s MU decreases as consumption or supply rises. Henceforth, the DMU law aids producers in setting pricing. Since consumers need to reach equilibrium, they buy more of the commodity to lower the MU. As a result, producers may be able to lower prices to boost sales. Simply said, buyers may attempt to link the marginal utility and price of the commodity. And that is why bigger quantities are purchased at lower costs.

Scheduling Purchases

The DMU law aids in the planning of purchases. A person can learn how to arrange purchases using the rule of diminishing returns. This rule explains when the point of satiety can be reached. This simply implies that this law allows a person to determine how many units are required to get maximum satisfaction. And, as a result, purchases can be planned properly. This also aids in the effective utilization of earnings.

Public Finance

In this case, too, the DMU law is useful. One can design the tax policy in such a way that it is progressive, with greater taxes for the wealthy. The government may be able to raise more funds this way. Since, typically, as earnings rise, the marginal utility of money decreases. In the field of public finance, a tax policy that taxes the rich more and the poor less may be beneficial. Levying a higher tax on products the rich enjoy could help in addressing income differences.

Understanding Welfare Measures

Welfare measures intend to develop policies that benefit the poor. As we’ve seen in the case of public finance, the public can extract benefits through cash raised by greater taxes on the rich. It finds its use in the forms of free education, health care for the poor, as well as food subsidies.